How to Build Credit Score in India: Complete Guide from 300 to 850

Published: July 31, 2025 | Reading Time: 10 minutes

Your credit score is one of the most important financial numbers in your life. In India, a good credit score (750+) can save you lakhs of rupees in loan interest and unlock premium credit cards with excellent benefits. Whether you’re starting from scratch or looking to improve an existing score, this comprehensive guide will show you exactly how to build and maintain an excellent credit score.

Understanding Credit Scores in India

What is a Credit Score?

A credit score is a three-digit number (300-850) that represents your creditworthiness. In India, four main credit bureaus calculate scores:

- CIBIL: Most widely used by banks

- Experian: Growing acceptance

- Equifax: Used by many NBFCs

- CRIF High Mark: Popular in South India

Credit Score Ranges

| Score Range | Rating | Loan Approval | Interest Rate |

|---|---|---|---|

| 750-850 | Excellent | Easy approval | Lowest rates |

| 700-749 | Good | High approval | Good rates |

| 650-699 | Fair | Moderate approval | Higher rates |

| 600-649 | Poor | Difficult approval | High rates |

| 300-599 | Very Poor | Very low approval | Very high rates |

Factors That Affect Your Credit Score

1. Payment History (35% weightage)

Most Important Factor

- Credit card payments: Pay full amount by due date

- Loan EMIs: Never miss personal, home, or car loan payments

- Late payments: Even 1-day delay can hurt your score

- Default history: Severely damages score for years

2. Credit Utilization (30% weightage)

How much credit you use vs available limit

- Ideal utilization: Below 30% of total limit

- Excellent score: Below 10% utilization

- Multiple cards: Spread usage across cards

- High utilization: Above 50% hurts score significantly

3. Length of Credit History (15% weightage)

- Older accounts: Keep your first credit card active

- Average account age: Longer history is better

- Don’t close old cards: Unless there’s annual fee

4. Credit Mix (10% weightage)

- Variety of credit: Credit cards + loans

- Secured credit: Home loans, car loans

- Unsecured credit: Credit cards, personal loans

5. New Credit Inquiries (10% weightage)

- Hard inquiries: When you apply for credit

- Too many inquiries: Shows credit hunger

- Space out applications: 3-6 months between applications

Step-by-Step Guide to Build Credit Score

Phase 1: Starting from Zero (Months 1-6)

Step 1: Get Your First Credit Product

Options for beginners:

- Secured Credit Card: Easiest approval, requires FD

- Student Credit Card: If you’re a student

- Add-on Card: From family member with good credit

- Basic Credit Card: From your salary account bank

Step 2: Use Credit Responsibly

- Small purchases: Start with ₹1,000-5,000 monthly

- Pay in full: Always pay entire amount by due date

- Set up auto-pay: Avoid any late payments

- Use 10-20%: Of available credit limit

Step 3: Monitor Progress

- Check score monthly: Use free CIBIL/bank apps

- Track payment history: Ensure all payments reflect

- Watch for errors: Dispute incorrect information

Phase 2: Building Good Credit (Months 6-18)

Step 1: Increase Credit Limit

- Request limit increase: Every 6 months

- Income increase: Submit updated salary slips

- Usage pattern: Show responsible usage

Step 2: Add Second Credit Card

- Different bank: Diversify credit sources

- No annual fee: Avoid unnecessary costs

- Spread usage: Use both cards regularly

Step 3: Maintain Low Utilization

- Combined utilization: Below 30% across all cards

- Pay before statement: Multiple payments per month

- Increase limits: To reduce utilization ratio

Phase 3: Achieving Excellent Credit (Months 18-36)

Step 1: Optimize Credit Portfolio

- 3-4 credit cards: From different banks

- Mix of secured loans: Consider home/car loan

- Total credit limit: 10-15x monthly income

Step 2: Perfect Payment Discipline

- Zero late payments: Set multiple payment reminders

- Pay before due date: 2-3 days early

- Full amount always: Never pay minimum due

Step 3: Strategic Credit Management

- Utilization under 10%: For excellent scores

- Keep old accounts: Don’t close first credit card

- Minimal inquiries: Apply for credit only when needed

Timeline: What to Expect

Month 1-3: Foundation Building

- Credit score appears: After first statement

- Score range: 600-650 typically

- Focus: Establish payment history

Month 4-12: Steady Growth

- Score improvement: 10-30 points per quarter

- Score range: 650-720

- Milestones: Second card approval becomes easier

Month 13-24: Good Credit Territory

- Score range: 720-750

- Benefits: Pre-approved loan offers

- Access: Premium credit cards

Month 25-36: Excellent Credit

- Score range: 750-800+

- Benefits: Lowest interest rates

- Access: Best credit cards and loans

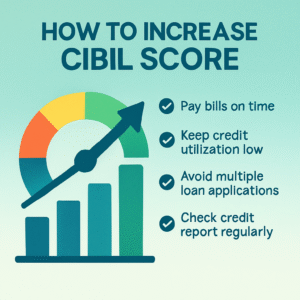

Quick Wins: Boost Your Score Fast

Immediate Actions (Impact in 1-2 months)

- Pay down balances: Reduce utilization to under 10%

- Pay before statement: Lower reported utilization

- Request limit increases: Instantly improves utilization ratio

- Check for errors: Dispute and correct mistakes

Medium-term Actions (Impact in 3-6 months)

- Add authorized user: Benefit from someone’s good credit

- Pay multiple times monthly: Keep balances low

- Use old cards: Small purchases to keep accounts active

- Set up auto-pay: Ensure perfect payment history

Common Mistakes That Hurt Credit Scores

Payment Mistakes

- Paying only minimum due: Shows financial stress

- Late payments: Even 1 day impacts score

- Skipping payments: Severely damages score

- Paying after closure: When card is already closed

Utilization Mistakes

- Maxing out cards: 90%+ utilization

- Concentrating on one card: Instead of spreading usage

- Not requesting limit increases: Missing easy utilization reduction

Account Management Mistakes

- Closing old accounts: Reduces credit history length

- Too many new accounts: Multiple inquiries in short time

- Not monitoring credit report: Missing errors and fraud

Advanced Strategies for 800+ Scores

Portfolio Optimization

- Credit mix: 70% credit cards, 30% instalment loans

- Account age: Average 3+ years

- Utilization strategy: Under 5% for 800+ scores

- Payment timing: Pay before statement generation

Strategic Borrowing

- Secured loans: Home loan improves credit mix

- Small personal loans: Quick EMI payment builds history

- Gold loans: Easy approval, quick closure

Free Tools to Monitor Your Credit

Official Sources

- CIBIL: One free report annually

- Experian: Free monthly score updates

- Equifax: Free annual report

- CRIF High Mark: Free report once per year

Bank Apps

- HDFC Bank: Monthly CIBIL score in mobile app

- ICICI Bank: Free score for customers

- SBI: CIBIL score in YONO app

- Axis Bank: Monthly score updates

Third-party Apps

- Paisa Bazaar: Free monthly CIBIL score

- Credit Mantri: Score monitoring and tips

- OneScore: Multi-bureau credit reports

Credit Score Myths Debunked

Common Myths

- Myth: Checking score hurts it

Reality: Soft inquiries don’t impact score - Myth: Income affects credit score

Reality: Income isn’t directly considered - Myth: Closing cards improves score

Reality: Usually hurts by reducing available credit - Myth: Paying extra improves score faster

Reality: Paying on time is what matters

Conclusion

Building an excellent credit score in India is a marathon, not a sprint. With consistent effort and smart financial habits, you can achieve a 750+ score within 18-24 months. Remember these key principles:

- Payment history is king: Never miss a payment

- Keep utilization low: Under 30%, ideally under 10%

- Be patient: Good credit takes time to build

- Monitor regularly: Check score and report monthly

- Stay disciplined: Consistent habits yield results

Your credit score is a powerful financial tool that can save you money and open doors to better financial products. Start building yours today!

Ready to start building your credit? Use our Credit Score Improvement Calculator to see how different actions will impact your score.

Disclaimer: Credit scores are calculated differently by each bureau. Results may vary based on individual circumstances. Always consult with financial advisors for personalized advice.

💳 Find Your Perfect Credit Card

Not sure which card suits you best? Try our Credit Card Finder Tool and get personalized recommendations in minutes.

Try the Finder Tool 🚀

Leave a Reply