🏆 Complete Metal Credit Cards Comparison

💎 Why Choose Metal Credit Cards?

Superior Durability and Prestige

Metal credit cards are crafted from premium materials like stainless steel, brass, or titanium alloys, making them significantly more durable than plastic cards. The weight and feel of metal cards convey prestige and exclusivity, often serving as conversation starters and status symbols in professional settings.

Enhanced Security Features

Most metal cards incorporate advanced security technologies including EMV chips, contactless payments, and some feature biometric authentication. The metal construction makes them resistant to wear and tear, ensuring chip and magnetic stripe integrity over time.

Premium Benefits Package

Metal cards typically come with significantly enhanced benefit packages compared to plastic counterparts. These include higher reward rates, comprehensive travel insurance, concierge services, and exclusive access to events and experiences not available to regular cardholders.

🎯 Detailed Card Analysis

🔍 How to Choose the Right Metal Card

Assess Your Spending Patterns

Analyze your monthly expenses across categories like dining, travel, fuel, groceries, and online shopping. Cards like ICICI Emeralde excel for hotel and dining spends, while HDFC Infinia offers broad-based rewards with travel acceleration.

Calculate Annual Value vs. Fees

Create a simple ROI calculation: (Annual rewards earned + Value of perks used) - Annual fee = Net value. For example, if you earn ₹30,000 in rewards and use ₹15,000 worth of lounge access annually, a ₹12,500 fee card delivers ₹32,500 net value.

Consider Income and Eligibility

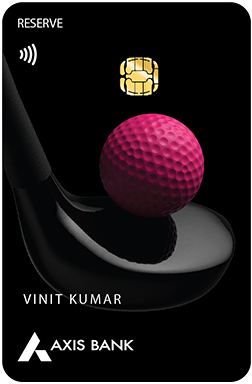

Most metal cards have specific income requirements and some are invitation-only. OneCard Metal is most accessible, while cards like Axis Reserve and ICICI Emeralde require relationship banking and high income proof.

📈 Maximizing Metal Card Benefits

Leverage Portal Multipliers

Cards like HDFC Infinia offer 10X rewards through SmartBuy, while ICICI Emeralde provides up to 18% returns via iShop. Route major purchases through these portals to maximize earnings.

Time Your Applications

Apply during promotional periods when banks offer enhanced welcome bonuses. Some cards provide milestone rewards worth ₹10,000-50,000 for spending thresholds in the first few months.

Optimize Redemptions

Travel redemptions typically offer 25-40% better value than cashback. Use points for flights and hotels rather than statement credits when possible.

⚠️ Common Pitfalls to Avoid

- Overspending for rewards: Don't increase spending just to earn points—the math rarely works out favorably

- Ignoring expiration dates: Most reward points expire after 2-3 years; plan redemptions accordingly

- Missing fee waiver criteria: Track annual spending to ensure you meet fee waiver thresholds

- Not using lounge access: If you don't travel frequently, lounge benefits won't justify premium fees

- Multiple applications: Avoid applying for several premium cards simultaneously as it impacts credit score

🚀 Future of Metal Credit Cards in India

The metal credit card segment in India is rapidly evolving with new entrants like OneCard disrupting traditional premium positioning. Expect to see more technology integration including biometric authentication, AI-powered spending insights, and seamless digital-first experiences. Environmental considerations are also driving innovation with eco-friendly metal alternatives and recycling programs.